Top Accounting Tips

This blog provides essential accounting tips to help US businesses stay tax-ready. It covers topics such as organizing financial records, leveraging t...

As tax season approaches, having a well-thought-out tax preparation plan is essential. The process can be overwhelming, but with the right strategies, you can navigate it smoothly. Whether you are an individual taxpayer or running a business, understanding the intricacies of the U.S. tax system can help you maximize deductions, minimize liabilities, and ensure compliance. This comprehensive guide from Winx Global will walk you through the essential steps for effective tax preparation.

Your filing status determines your tax bracket, eligibility for credits, and deductions. The five main statuses are:

Single: For individuals who are unmarried or legally separated.

Married Filing Jointly: For married couples who combine their income and deductions.

Married Filing Separately: For married couples who file separately.

Head of Household: For individuals who are unmarried and support a qualifying person.

Qualifying Widow(er) with Dependent Child: For widows or widowers with a dependent child.

Each status has unique benefits and implications. Choosing the correct status can optimize your tax situation.

Organized and thorough record-keeping is the cornerstone of successful tax preparation. Key documents you’ll need include:

W-2 Forms: Provided by your employer, detailing your annual earnings and withheld taxes.

1099 Forms: For additional income sources such as freelance work, interest, dividends, and retirement plan distributions.

Receipts: For deductible expenses like medical costs, charitable contributions, and business expenses.

Mortgage Interest Statements: Essential for homeowners to claim mortgage interest deductions.

Investment Income Statements: Including dividends, capital gains, and other investment-related income.

Charitable Contributions Receipts: Required to claim deductions for donations.

Medical Expense Receipts: For claiming medical expenses above a certain percentage of your income.

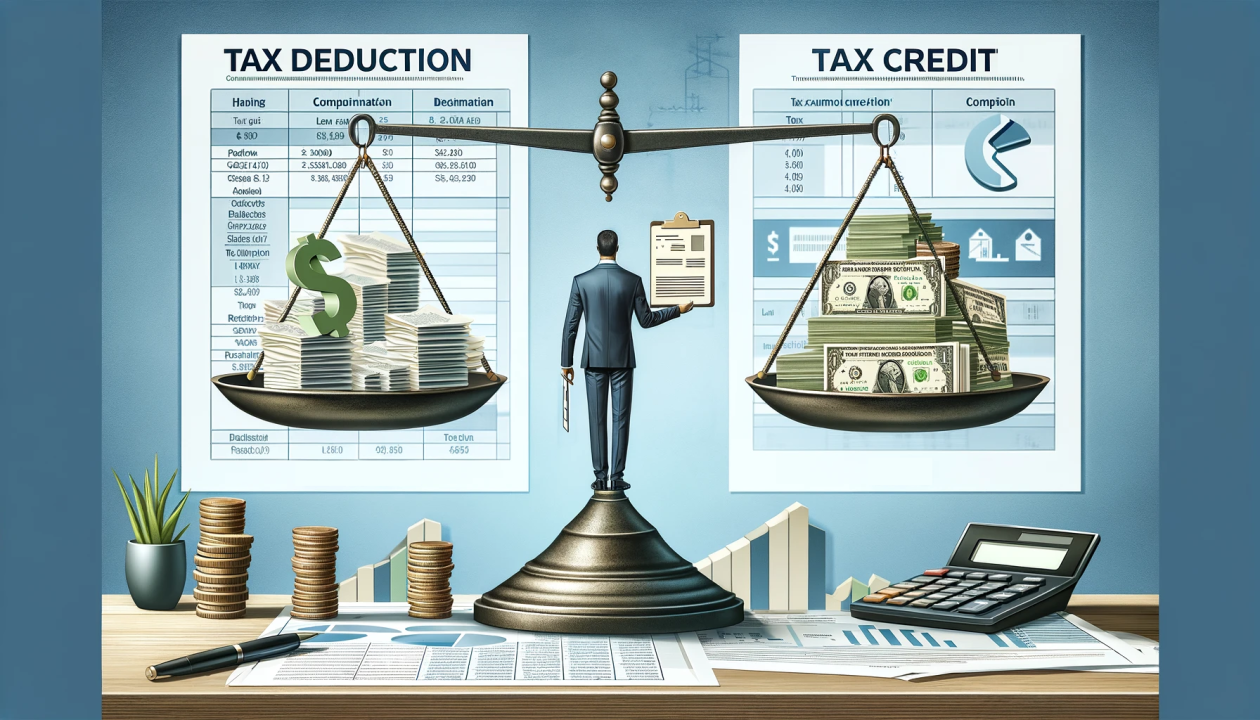

Deductions and credits can significantly reduce your tax burden. Common deductions include:

Standard Deduction: A fixed amount that reduces your taxable income.

Itemized Deductions: For expenses like medical expenses, mortgage interest, state and local taxes, and charitable contributions.

Education Credits: The American Opportunity Credit and Lifetime Learning Credit can help offset education costs.

Child Tax Credit: Available to taxpayers with qualifying dependents.

Earned Income Tax Credit (EITC): For low-to-moderate-income workers.

Maximize contributions to tax-deferred accounts to reduce taxable income. Options include:

401(k) Plans: Contributions reduce taxable income, and the funds grow tax-deferred until withdrawal.

Individual Retirement Accounts (IRAs): Traditional IRA contributions may be tax-deductible, and the funds grow tax-deferred.

Health Savings Accounts (HSAs): Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

Tax preparation can be complex, especially for businesses and individuals with multiple income sources. Professional help from Certified Public Accountants (CPAs) or Enrolled Agents (EAs) can ensure accuracy and compliance. Winx Global offers expert tax advisory services to help you navigate the complexities of the tax system, optimize your returns, and stay compliant with regulations.

Tax laws are continually evolving. Stay informed about changes to ensure compliance and take advantage of new opportunities. Reliable sources include the IRS website, professional tax advisors, and reputable financial news outlets.

Filing your taxes electronically is efficient and secure. The IRS e-file system provides immediate confirmation of receipt, reducing the risk of lost or delayed returns. Additionally, filing early can help you avoid the last-minute rush and allows time to address any issues that may arise.

Tax preparation is not just a yearly task; it’s an ongoing process. Use the insights gained from your current tax situation to plan for the future. Adjust your withholdings, keep thorough records of deductible expenses, and stay organized throughout the year to make next tax season more manageable.

Effective tax preparation requires organization, knowledge, and proactive planning. By understanding your filing status, gathering necessary documents, maximizing deductions and credits, leveraging tax-deferred accounts, engaging professional help, staying informed on tax law changes, filing electronically and early, and planning for the future, you can navigate tax season with confidence. Whether you're an individual taxpayer or a business owner, these strategies, supported by Winx Global, will help you optimize your tax situation and achieve financial peace of mind.

This blog provides essential accounting tips to help US businesses stay tax-ready. It covers topics such as organizing financial records, leveraging t...

Small businesses in America enjoy various tax benefits that help reduce their financial burdens and support growth. These include deductions for busin...

This blog explores essential tips for expatriates navigating the US tax system, covering residency status, tax treaties, deductions like the Foreign E...

Understanding U.S. tax laws is vital for both compliance and maximizing financial savings. This comprehensive guide simplifies the complexities of the...

Learn how to make tax season stress-free in 2025 with expert tips on staying organized, leveraging deductions, and avoiding common pitfalls. Simplify...

Automation is transforming tax preparation by enhancing accuracy, efficiency, and compliance. Automated systems reduce errors, save time, and stay upd...

Navigating taxes can be challenging for freelancers and small business owners. This blog provides essential tax strategies to maximize savings and ens...

Preparing for a successful financial year-end close is crucial for maintaining the financial health of your business. This process involves reviewing...

This comprehensive guide offers invaluable tips and strategies to help you save on taxes. From understanding deductions and credits to contributing to...

Avoid common tax pitfalls this season! Our latest blog "Top 5 Tax Mistakes to Avoid This Year" offers essential tips to help you file accurately and m...

Effective tax planning is essential for small business owners to minimize liabilities and maximize deductions. In this blog, we explore key strategies...

Unlock the potential for your small business growth by understanding and leveraging various tax credits. This blog explores key tax credits such as th...

Tax season can be overwhelming, but with the right strategies, you can make the most of your tax return. Our comprehensive guide offers valuable tips...

Discover the top tax deductions available for small businesses in the United States. This comprehensive guide helps small business owners navigate the...

Learn everything you need to know about filling out IRS Form 8862 to reclaim disallowed tax credits. Our step-by-step guide will help you navigate the...

In the digital age, protecting sensitive financial information is paramount for tax accounting firms. This blog explores the importance of cybersecuri...

This blog provides a comprehensive guide for new taxpayers to navigate the US tax system. It covers essential topics such as federal and state taxes,...

Navigating tax season can be daunting, but an accountant's expertise can make all the difference. This blog explores how accountants help individuals...

Discover how global accounting services can streamline your international business operations. Learn about the benefits, challenges, and why Winx Glob...

Discover the critical importance of historical accounting cleanup in ensuring financial accuracy and reliability. This blog explores the common issues...

Migrating to a new accounting system can be a complex and daunting task for businesses. This comprehensive guide provides step-by-step instructions to...

Effective management of Accounts Payable (AP) and Accounts Receivable (AR) is critical for maintaining healthy cash flow and ensuring business success...

Discover the essential steps to reclaim your refundable tax credits after they’ve been disallowed. This comprehensive guide will help you navigate the...

Unlock the secrets to a smooth and efficient month-end close process with our essential guide. Tailored for businesses in the USA and Canada, this blo...

Financial modeling is a vital tool for businesses in the USA, enabling informed decision-making, strategic planning, and risk management. This blog ex...

Dive into our comprehensive guide on US tax planning and preparation. Learn about the different types of taxes, effective planning strategies, and ste...

Discover simple and effective strategies to reduce your tax burden in 2025. From maximizing retirement contributions to leveraging tax credits and ite...

Preparing for tax season can be stressful, but with the right approach, you can maximize your savings and streamline the process. This blog provides a...

If you're a small business owner transitioning from Bench Accounting due to its shutdown, don't worry—Winx Global has you covered. This blog outlines...

As bench clients transition to wind energy, this blog explores the reasons behind the shift, the steps involved in making the change, and real-world e...

Explore the impact of Bench Accounting's sudden shutdown on your business, including data access issues, bookkeeping interruptions, and tax preparatio...

Discover how to navigate the sudden shutdown of Bench Accounting. This comprehensive guide covers the impact on businesses, immediate steps to secure...

Discover how you can maximize your tax savings with our comprehensive guide. Learn the ins and outs of key tax deductions and credits that can signifi...

Explore how to reclaim your tax credits using IRS Form 8862. This guide covers eligibility, filing steps, common mistakes, and important consideration...

Discover everything you need to know about Schedule C (Form 1040), the essential tax form for sole proprietors. This comprehensive guide covers who ne...

Understanding Tax Form "Schedule A": Discover how to navigate Tax Form "Schedule A" to maximize your deductions and reduce your taxable income. Learn...

Understanding IRS Form W-4: Your Guide to Withholding Allowances Form W-4 is a critical tax document that helps U.S. employees determine how much fed...

Form W-2, also known as the Wage and Tax Statement, is a vital document for U.S. employees and employers. It summarizes an employee's earnings and the...

Discover the top tax deductions for 2024 and learn how to maximize your savings! Our comprehensive guide covers key deductions, from standard and home...

This blog provides actionable strategies to save on taxes in the USA, including maximizing retirement contributions, leveraging health savings account...

Tax season can be confusing, but understanding the various U.S. tax forms is crucial for filing accurately and maximizing your returns. This comprehen...

This comprehensive guide simplifies tax season by exploring the various tax deductions and credits available on IRS Form 1040. Learn how to reduce you...

Dive into this comprehensive guide on IRS Form 1040, the key to filing your federal income taxes. Learn about its history, sections, important deadlin...

Taxation is the process by which governments collect revenue from individuals and businesses to fund public services and infrastructure. There are var...

This comprehensive guide demystifies the complex world of US taxes, covering various tax types, the intricacies of tax brackets, essential tips for fi...

Navigating the US tax season can be challenging, but with proper preparation and knowledge, it doesn't have to be. This comprehensive guide covers eve...

Discover the essential guide to 1099 filing requirements and deadlines for 2024. Learn about different 1099 forms, key filing dates, penalties for lat...

USA Tax Advisory: Navigating New Tax Laws for Smart Financial Planning Stay ahead with expert insights on the latest USA tax law changes for 2024. Th...

Join Winx Global as we reflect on a year of growth and express our heartfelt gratitude to our clients, partners, and team members this Thanksgiving.

Winx Global stands out as the premier accounting firm in the US, offering a comprehensive range of financial services designed to meet both personal a...

Winx Global Bookkeeping Services At Winx Global, we provide professional bookkeeping and accounting services designed to support small businesses in...

Offshore Accounting Partner: A Strategic Move for Business Growth Partnering with an offshore accounting firm can provide businesses with cost savi...