How Bench Accounting Shutdown is Impacting Your Business

Explore the impact of Bench Accounting's sudden shutdown on your business, including data access issues, bookkeeping interruptions, and tax preparatio...

Taxation is a cornerstone of modern economies, essential for funding government operations, public services, and infrastructure. Understanding the various types of taxes, their importance, and how they are implemented around the world can help demystify this complex yet crucial system.

Taxation systems around the world can vary widely, but they generally fall into a few broad categories:

Income Tax: Income tax is levied on the earnings of individuals and businesses. It can be progressive, where tax rates increase with higher income levels, or flat, where everyone pays the same rate regardless of income.

Personal Income Tax: This tax is on the wages, salaries, and other earnings of individuals. It often includes various deductions and credits to incentivize specific behaviors, like education and homeownership.

Corporate Income Tax: Imposed on the profits of corporations, this tax is crucial for funding government activities but also impacts business investment and growth.

Sales Tax: Sales tax is a consumption tax imposed on the sale of goods and services. It is typically collected by the retailer at the point of sale and then passed on to the government.

Value-Added Tax (VAT): A type of sales tax that's levied at each stage of production and distribution. It is widely used in many countries and ensures that tax is paid on the value added at each step of the supply chain.

Property Tax: Based on the value of owned property, including land and buildings, property tax is a significant source of revenue for local governments. It funds essential services like public schools, police, and fire departments.

Excise Tax: This tax is imposed on specific goods such as alcohol, tobacco, and fuel. It is often used to discourage the consumption of harmful products and can vary significantly between jurisdictions.

Capital Gains Tax: Levied on the profit from the sale of assets or investments, capital gains tax is significant for individuals and businesses involved in trading stocks, bonds, or real estate. This tax encourages long-term investment and economic stability.

Estate and Inheritance Tax: Taxes on the transfer of wealth upon death. These taxes are designed to ensure that wealth is distributed more evenly across society.

Taxation serves several essential functions in society:

Funding Public Services: Taxes are crucial for maintaining public infrastructure, social services, education, healthcare, and defense. Without tax revenue, governments wouldn't have the resources to provide these vital services.

Redistribution of Wealth: Progressive taxation helps reduce income inequality by redistributing wealth from higher earners to those in need through welfare programs and social security.

Economic Regulation: Governments use taxation to influence economic conditions. By adjusting tax rates, they can control inflation, encourage investment, and manage economic growth.

Behavioral Influence: Taxes on products like cigarettes and alcohol can reduce their consumption, promoting public health. Similarly, environmental taxes can encourage businesses and individuals to adopt more sustainable practices.

Tax systems can vary significantly around the world, reflecting different economic structures and societal values:

United States: Features a progressive income tax system with federal, state, and local taxes. The U.S. tax system includes various deductions and credits to incentivize behaviors such as homeownership and education.

India: Implements the Goods and Services Tax (GST), a comprehensive indirect tax on the manufacture, sale, and consumption of goods and services at the national level. The GST has replaced multiple indirect taxes, simplifying the tax system and reducing the overall tax burden.

Sweden: Known for its high tax rates, Sweden uses these funds to provide extensive social services, including free healthcare, education, and a robust welfare system. The tax system is highly progressive, aiming to ensure a high standard of living for all citizens.

The world of taxation is not without its challenges:

Tax Evasion and Avoidance: These practices result in significant revenue losses for governments. Efforts to combat tax evasion include stricter enforcement of tax laws and international cooperation to track offshore accounts.

Globalization: As businesses operate across borders, harmonizing tax policies and preventing tax base erosion become critical challenges. International bodies like the OECD work on frameworks to address these issues.

Technological Advancements: The rise of the digital economy requires updates to existing tax laws and frameworks. Governments must adapt to ensure fair taxation of digital services and e-commerce.

Fair Taxation: Ensuring that taxation is fair and equitable is a constant challenge. This includes addressing loopholes that allow large corporations and wealthy individuals to minimize their tax liabilities.

Taxation is a multifaceted and vital component of modern society. It funds essential services, promotes economic stability, and ensures social equity. By understanding its mechanisms and impacts, individuals and businesses can navigate their financial responsibilities and contribute to the overall well-being of society.

Staying informed about tax policies and their implications is crucial for anyone looking to make informed financial decisions, whether on a personal or business level. Taxation may be complex, but it plays an indispensable role in the fabric of our economic and social systems.

Explore the impact of Bench Accounting's sudden shutdown on your business, including data access issues, bookkeeping interruptions, and tax preparatio...

Discover how to navigate the sudden shutdown of Bench Accounting. This comprehensive guide covers the impact on businesses, immediate steps to secure...

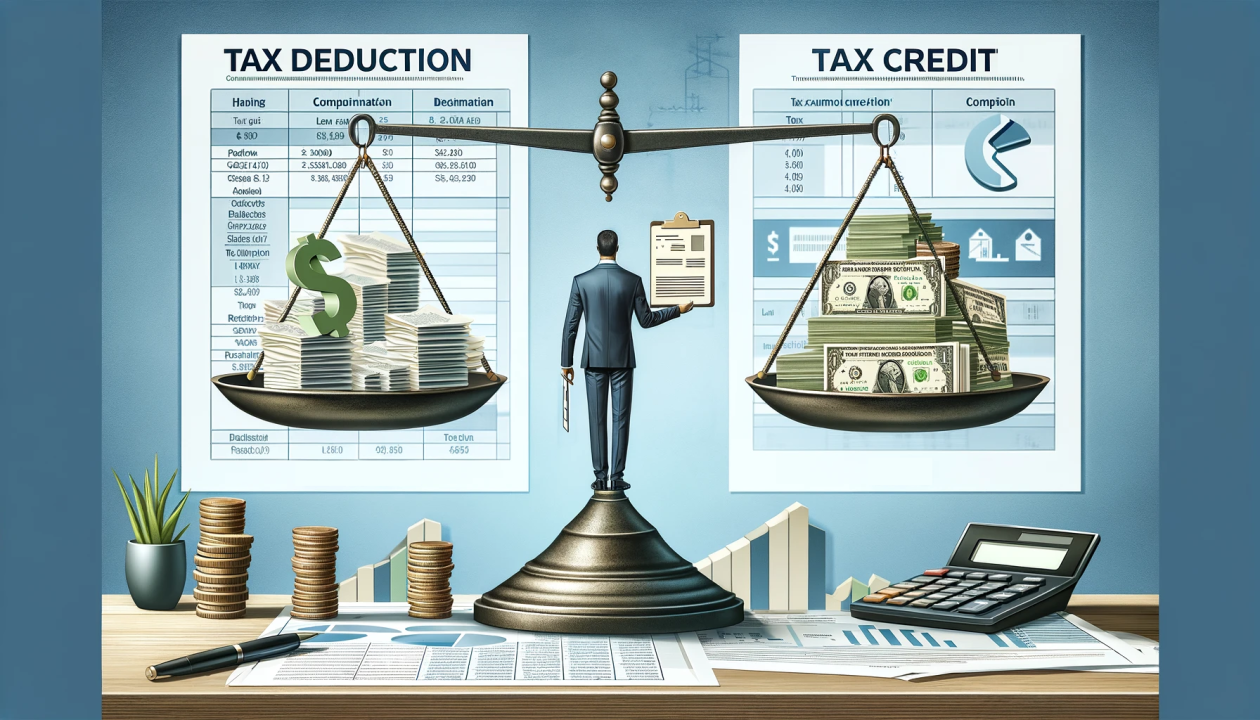

Discover how you can maximize your tax savings with our comprehensive guide. Learn the ins and outs of key tax deductions and credits that can signifi...

Explore how to reclaim your tax credits using IRS Form 8862. This guide covers eligibility, filing steps, common mistakes, and important consideration...

Discover everything you need to know about Schedule C (Form 1040), the essential tax form for sole proprietors. This comprehensive guide covers who ne...

Understanding Tax Form "Schedule A": Discover how to navigate Tax Form "Schedule A" to maximize your deductions and reduce your taxable income. Learn...

Understanding IRS Form W-4: Your Guide to Withholding Allowances Form W-4 is a critical tax document that helps U.S. employees determine how much fed...

Form W-2, also known as the Wage and Tax Statement, is a vital document for U.S. employees and employers. It summarizes an employee's earnings and the...

Discover the top tax deductions for 2024 and learn how to maximize your savings! Our comprehensive guide covers key deductions, from standard and home...

This blog provides actionable strategies to save on taxes in the USA, including maximizing retirement contributions, leveraging health savings account...

Tax season can be confusing, but understanding the various U.S. tax forms is crucial for filing accurately and maximizing your returns. This comprehen...

This comprehensive guide simplifies tax season by exploring the various tax deductions and credits available on IRS Form 1040. Learn how to reduce you...

Dive into this comprehensive guide on IRS Form 1040, the key to filing your federal income taxes. Learn about its history, sections, important deadlin...

"Mastering Tax Preparation: Strategies for U.S. Taxpayers" Get ready for tax season with our comprehensive guide on tax preparation tailored for U.S....

This comprehensive guide demystifies the complex world of US taxes, covering various tax types, the intricacies of tax brackets, essential tips for fi...

Navigating the US tax season can be challenging, but with proper preparation and knowledge, it doesn't have to be. This comprehensive guide covers eve...

Discover the essential guide to 1099 filing requirements and deadlines for 2024. Learn about different 1099 forms, key filing dates, penalties for lat...

USA Tax Advisory: Navigating New Tax Laws for Smart Financial Planning Stay ahead with expert insights on the latest USA tax law changes for 2024. Th...

Join Winx Global as we reflect on a year of growth and express our heartfelt gratitude to our clients, partners, and team members this Thanksgiving.

Winx Global stands out as the premier accounting firm in the US, offering a comprehensive range of financial services designed to meet both personal a...

Winx Global Bookkeeping Services At Winx Global, we provide professional bookkeeping and accounting services designed to support small businesses in...

Offshore Accounting Partner: A Strategic Move for Business Growth Partnering with an offshore accounting firm can provide businesses with cost savi...