Top Accounting Tips

This blog provides essential accounting tips to help US businesses stay tax-ready. It covers topics such as organizing financial records, leveraging t...

Navigating tax regulations and optimizing your financial strategies in the USA can be complex, but with the right tax advisory services, you can make informed decisions to effectively manage your liabilities and maximize returns. Whether you are an individual, a small business owner, or part of a corporation, understanding local tax rates and planning accordingly is crucial for financial success. Tax advisors in the USA typically offer services such as corporate tax returns, tax planning, estate and succession planning, as well as guidance on business transactions including purchase, sale, and reorganizations.

1. Standard Deduction Increases: The standard deduction for married couples filing jointly rises to $29,200, an increase of $1,500 from tax year 2023. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2024, an increase of $750 from 2023. For heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the amount for tax year 2023.

2. Marginal Tax Rates: The top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly). Other rates are adjusted accordingly.

3. Alternative Minimum Tax (AMT): The AMT exemption amount for tax year 2024 is $85,700 and begins to phase out at $609,350 ($133,300 for married couples filing jointly).

4. Earned Income Tax Credit (EITC): The maximum EITC amount for tax year 2024 is $7,830 for qualifying taxpayers who have three or more qualifying children, an increase from $7,430 for tax year 2023.

5. Retirement Plan Changes: The SECURE 2.0 Act of 2022 introduces several changes, including penalty-free early withdrawals from IRAs and 401(k)s for domestic abuse victims and emergencies, rollovers from 529 education accounts to Roth IRAs, and increased contribution limits for retirement plans.

6. Qualified Charitable Distributions: IRA owners aged 70½ and older can transfer up to $105,000 in 2024 from their IRAs directly to charity without paying tax on the withdrawal.

When seeking tax advisory services in the USA, you’ll find a variety of tailored options designed to meet the specific needs of both individuals and businesses.

Your business can benefit from comprehensive corporate tax solutions that encompass everything from the preparation of corporate tax returns to strategic guidance on business transactions including purchases, sales, reorganizations, and amalgamations. Local chartered accountants can assist with corporate financial planning, ensuring compliance with tax legislation while optimizing your tax position.

Estate and trust services are crucial for effectively managing and transitioning your wealth. This includes assistance with the preparation of estate and trust tax returns as well as making sure all property taxes are paid and up to date. By leveraging professional expertise, you can ensure your assets are managed according to your wishes while minimizing tax liabilities.

Engaging with a tax advisory in the USA ensures that you have personalized tax services tailored to meet your unique financial situation. The process is comprehensive, involving an initial consultation, strategy development, and diligent implementation.

Your journey begins with an initial consultation with a tax advisor. This session is pivotal as it allows you to present your financial documents and discuss your tax concerns. It’s a collaborative meeting where your advisor will seek to understand your business or personal tax scenario comprehensively.

Following the consultation, the assessment and strategy development phase takes place. Advisors evaluate your financial information to identify opportunities for tax optimization. They devise a strategic tax plan that aligns with your objectives, whether it’s for corporate tax filing or personal tax management.

The final phase is implementation and monitoring. Your tax advisor will put the strategic plan into action, managing filings and deadlines with precision. As regulations change, they will monitor the impact on your financial position and adjust the strategy accordingly, ensuring ongoing compliance and optimization.

By incorporating these tailored services from local accountants, you stand to enhance your financial health with expert tax guidance. For more details, visit https://www.winxglobal.in.

Selecting a tax advisor is a crucial decision that can impact your financial health. Here’s what you need to know to make informed choices and optimize your tax situation.

When searching for a tax advisor in the USA, ensure they are a Certified Public Accountant (CPA), which signifies a recognized standard of expertise and ethics in accounting. Experience with USA tax law and a track record of dealing with similar financial situations to yours are also important.

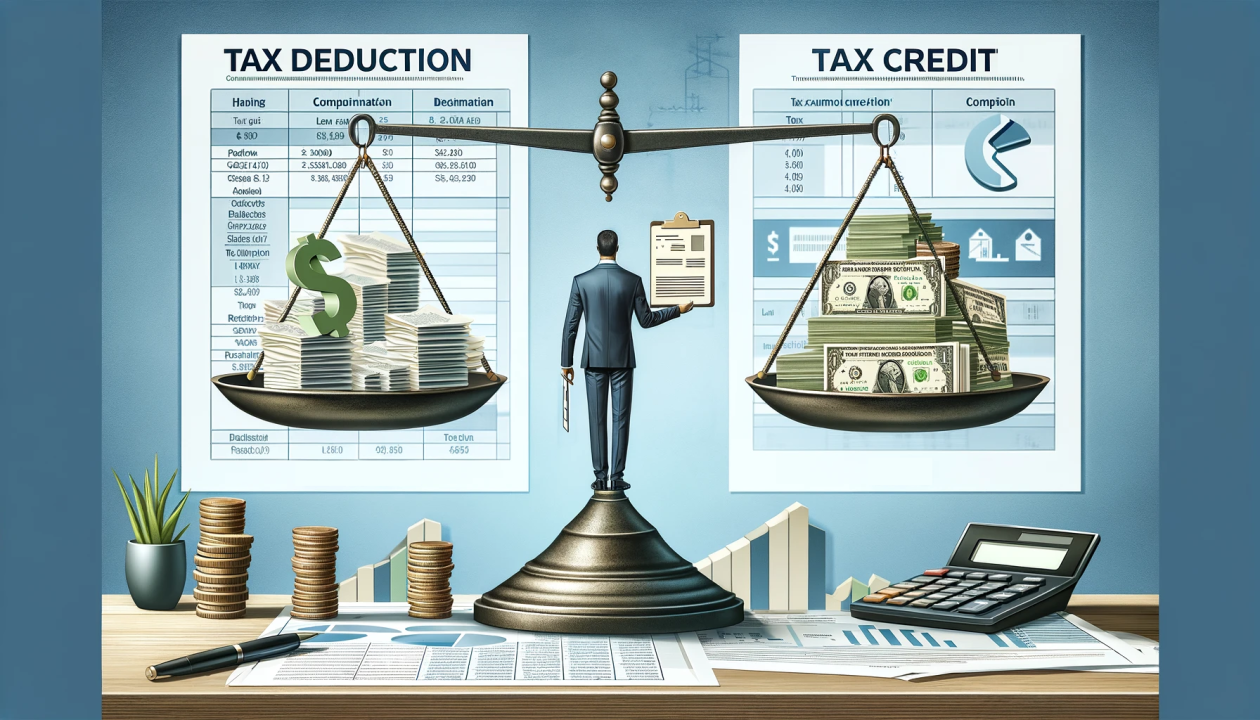

A tax advisor can create personalized tax planning strategies to help individuals and businesses reduce their tax obligations, comply with tax laws, and optimize financial outcomes by taking advantage of tax credits, deductions, and investment opportunities.

Hiring a tax advisor can be very beneficial for small businesses in the USA. They offer expertise in tax planning, compliance, and can help navigate the complexities of the USA tax system, ultimately saving time and reducing the overall tax burden.

Tax advisors employ strategies such as income splitting, timing of income and deductions, investments in tax-advantaged accounts, and taking advantage of eligible tax credits and deductions to reduce tax liability for their clients.

Consulting with a tax advisor at least annually or whenever you have significant changes in your financial situation is advised to maintain tax efficiency. Regular reviews can help you stay on top of new tax legislation and planning opportunities.

Working with a local tax advisory firm in the USA offers a better understanding of local tax regulations and opportunities. They can provide personalized service and are more accessible for face-to-face consultations to discuss and adapt your tax strategy as needed.

---

This blog provides essential accounting tips to help US businesses stay tax-ready. It covers topics such as organizing financial records, leveraging t...

Small businesses in America enjoy various tax benefits that help reduce their financial burdens and support growth. These include deductions for busin...

This blog explores essential tips for expatriates navigating the US tax system, covering residency status, tax treaties, deductions like the Foreign E...

Understanding U.S. tax laws is vital for both compliance and maximizing financial savings. This comprehensive guide simplifies the complexities of the...

Learn how to make tax season stress-free in 2025 with expert tips on staying organized, leveraging deductions, and avoiding common pitfalls. Simplify...

Automation is transforming tax preparation by enhancing accuracy, efficiency, and compliance. Automated systems reduce errors, save time, and stay upd...

Navigating taxes can be challenging for freelancers and small business owners. This blog provides essential tax strategies to maximize savings and ens...

Preparing for a successful financial year-end close is crucial for maintaining the financial health of your business. This process involves reviewing...

This comprehensive guide offers invaluable tips and strategies to help you save on taxes. From understanding deductions and credits to contributing to...

Avoid common tax pitfalls this season! Our latest blog "Top 5 Tax Mistakes to Avoid This Year" offers essential tips to help you file accurately and m...

Effective tax planning is essential for small business owners to minimize liabilities and maximize deductions. In this blog, we explore key strategies...

Unlock the potential for your small business growth by understanding and leveraging various tax credits. This blog explores key tax credits such as th...

Tax season can be overwhelming, but with the right strategies, you can make the most of your tax return. Our comprehensive guide offers valuable tips...

Discover the top tax deductions available for small businesses in the United States. This comprehensive guide helps small business owners navigate the...

Learn everything you need to know about filling out IRS Form 8862 to reclaim disallowed tax credits. Our step-by-step guide will help you navigate the...

In the digital age, protecting sensitive financial information is paramount for tax accounting firms. This blog explores the importance of cybersecuri...

This blog provides a comprehensive guide for new taxpayers to navigate the US tax system. It covers essential topics such as federal and state taxes,...

Navigating tax season can be daunting, but an accountant's expertise can make all the difference. This blog explores how accountants help individuals...

Discover how global accounting services can streamline your international business operations. Learn about the benefits, challenges, and why Winx Glob...

Discover the critical importance of historical accounting cleanup in ensuring financial accuracy and reliability. This blog explores the common issues...

Migrating to a new accounting system can be a complex and daunting task for businesses. This comprehensive guide provides step-by-step instructions to...

Effective management of Accounts Payable (AP) and Accounts Receivable (AR) is critical for maintaining healthy cash flow and ensuring business success...

Discover the essential steps to reclaim your refundable tax credits after they’ve been disallowed. This comprehensive guide will help you navigate the...

Unlock the secrets to a smooth and efficient month-end close process with our essential guide. Tailored for businesses in the USA and Canada, this blo...

Financial modeling is a vital tool for businesses in the USA, enabling informed decision-making, strategic planning, and risk management. This blog ex...

Dive into our comprehensive guide on US tax planning and preparation. Learn about the different types of taxes, effective planning strategies, and ste...

Discover simple and effective strategies to reduce your tax burden in 2025. From maximizing retirement contributions to leveraging tax credits and ite...

Preparing for tax season can be stressful, but with the right approach, you can maximize your savings and streamline the process. This blog provides a...

If you're a small business owner transitioning from Bench Accounting due to its shutdown, don't worry—Winx Global has you covered. This blog outlines...

As bench clients transition to wind energy, this blog explores the reasons behind the shift, the steps involved in making the change, and real-world e...

Explore the impact of Bench Accounting's sudden shutdown on your business, including data access issues, bookkeeping interruptions, and tax preparatio...

Discover how to navigate the sudden shutdown of Bench Accounting. This comprehensive guide covers the impact on businesses, immediate steps to secure...

Discover how you can maximize your tax savings with our comprehensive guide. Learn the ins and outs of key tax deductions and credits that can signifi...

Explore how to reclaim your tax credits using IRS Form 8862. This guide covers eligibility, filing steps, common mistakes, and important consideration...

Discover everything you need to know about Schedule C (Form 1040), the essential tax form for sole proprietors. This comprehensive guide covers who ne...

Understanding Tax Form "Schedule A": Discover how to navigate Tax Form "Schedule A" to maximize your deductions and reduce your taxable income. Learn...

Understanding IRS Form W-4: Your Guide to Withholding Allowances Form W-4 is a critical tax document that helps U.S. employees determine how much fed...

Form W-2, also known as the Wage and Tax Statement, is a vital document for U.S. employees and employers. It summarizes an employee's earnings and the...

Discover the top tax deductions for 2024 and learn how to maximize your savings! Our comprehensive guide covers key deductions, from standard and home...

This blog provides actionable strategies to save on taxes in the USA, including maximizing retirement contributions, leveraging health savings account...

Tax season can be confusing, but understanding the various U.S. tax forms is crucial for filing accurately and maximizing your returns. This comprehen...

This comprehensive guide simplifies tax season by exploring the various tax deductions and credits available on IRS Form 1040. Learn how to reduce you...

Dive into this comprehensive guide on IRS Form 1040, the key to filing your federal income taxes. Learn about its history, sections, important deadlin...

Taxation is the process by which governments collect revenue from individuals and businesses to fund public services and infrastructure. There are var...

"Mastering Tax Preparation: Strategies for U.S. Taxpayers" Get ready for tax season with our comprehensive guide on tax preparation tailored for U.S....

This comprehensive guide demystifies the complex world of US taxes, covering various tax types, the intricacies of tax brackets, essential tips for fi...

Navigating the US tax season can be challenging, but with proper preparation and knowledge, it doesn't have to be. This comprehensive guide covers eve...

Discover the essential guide to 1099 filing requirements and deadlines for 2024. Learn about different 1099 forms, key filing dates, penalties for lat...

Join Winx Global as we reflect on a year of growth and express our heartfelt gratitude to our clients, partners, and team members this Thanksgiving.

Winx Global stands out as the premier accounting firm in the US, offering a comprehensive range of financial services designed to meet both personal a...

Winx Global Bookkeeping Services At Winx Global, we provide professional bookkeeping and accounting services designed to support small businesses in...

Offshore Accounting Partner: A Strategic Move for Business Growth Partnering with an offshore accounting firm can provide businesses with cost savi...